Bombay Stock Exchange Limited (the Exchange) is the oldest stock exchange in Asia with a rich heritage. Popularly known as ‘BSE’, it was established as ‘The Native Share & Stock Brokers Association’ in 1875. It is the first stock exchange in the country to obtain permanent recognition in 1956 from the Government of India under the Securities Contracts (Regulation) Act, 1956.The Exchange’s pivotal and pre-eminent role in the development of the Indian capital market is widely recognized and its index, SENSEX, is tracked worldwide. Earlier an Association of Persons (AOP), the Exchange is now a demutualised and corporatised entity incorporated under the provisions of the Companies Act, 1956, pursuant to the BSE (Corporatisation and Demutualisation) Scheme, 2005 notified by the Securities and Exchange Board of India (SEBI).Bombay Stock Exchange Limited received its Certificate of Incorporation on 8th August, 2005 and Certificate of Commencement of Business on 12th August, 2005. The ‘Due Date’ for taking over the business and operations of the BSE, by the Exchange was fixed for 19th August, 2005, under the Scheme. The Exchange has succeeded the business and operations of BSE on going concern basis and its recognition as an Exchange has been continued by SEBI.

With demutualisation, the trading rights and ownership rights have been de-linked effectively addressing concerns regarding perceived and real conflicts of interest. The Exchange is professionally managed under the overall direction of the Board of Directors. The Board comprises eminent professionals, representatives of Trading Members and the Managing Director of the Exchange. The Board is inclusive and is designed to benefit from the participation of market intermediaries.

In terms of organisation structure, the Board formulates larger policy issues and exercises over-all control. The committees constituted by the Board are broad-based. The day-to-day operations of the Exchange are managed by the Managing Director & CEO and a management team of professionals.

The Exchange has a nation-wide reach with a presence in 417 cities and towns of India. The systems and processes of the Exchange are designed to safeguard market integrity and enhance transparency in operations. During the year 2004-2005, the trading volumes on the Exchange showed robust growth.

The Exchange provides an efficient and transparent market for trading in equity, debt instruments and derivatives. The BSE’s On Line Trading System is a proprietory system of the Exchange and is BS 7799-2-2002 certified. The surveillance and clearing & settlement functions of the Exchange are ISO 9001:2000 certified.

The oldest exchange in Asia and the first exchange in the country to be granted permanent recognition under the Securities Contract Regulation Act, 1956, Bombay Stock Exchange Limited (BSE) has had an interesting rise to prominence over the past 130 years.

While the BSE is now synonymous with Dalal Street, it wasn’t always so. In fact the first venues of the earliest stock broker meetings in the 1850s were amidst rather natural environs—under banyan trees—in front of the Town Hall, where Horniman Circle is now situated. A decade later, the brokers moved their venue to another set of foliage, this time under banyan trees at the junction of Meadows Street and Mahatma Gandhi Road. As the number of brokers increased, they had to shift from place to place, and wherever they went, through sheer habit, they overflowed in to the streets. At last, in 1874, found a permanent place, and one that they could, quite literally, call their own. The new place was, aptly, called Dalal Street.

The journey of BSE is as eventful and interesting as the history of India’s securities markets. India’s biggest bourse, in terms of listed companies and market capitalisation, BSE has played a pioneering role in the Indian Securities Market—one of the oldest in the world. Much before actual legislations were enacted, BSE had formulated comprehensive set of Rules and Regulations for the Indian Capital Markets. It also laid down best practices adopted by the Indian Capital Markets after India gained its Independence.

Perhaps, there would not be any leading corporate in India, which has not sourced BSE’s services in resource mobilization.

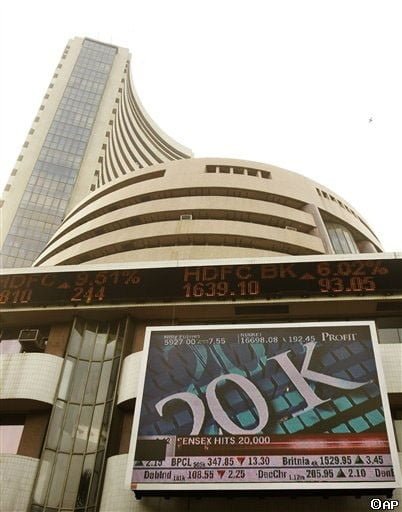

BSE as a brand is synonymous with capital markets in India. The BSE Sensex is the benchmark equity index that reflects the robustness of the economy and finance. At par with international standards, BSE has been a pioneer in several areas. It has several firsts to its credit even in an intensely competitive environment.

- First in India to introduce Equity Derivatives

- First in India to launch a Free Float Index

- First in India to launch US$ version of BSE Sensex

- First in India to launch Exchange Enabled Internet Trading Platform

- First in India to obtain ISO certification for Surveillance, Clearing & Settlement

- ‘BSE On-Line Trading System’ has been awarded the globally recognised the Information Security Management System standard BS7799-2:2002.

- First to have an exclusive facility for financial training

- Moved from Open Outcry to Electronic Trading within just 50 days

An equally important accomplishment of BSE is the launch of a nationwide investor awareness campaign—Safe Investing in the Stock Market—under which nationwide awareness campaigns and dissemination of information through print and electronic medium was undertaken. BSE also actively promoted the securities market awareness campaign of the Securities and Exchange Board of India.

In 2002, the name The Stock Exchange, Mumbai, was changed to BSE. BSE, which had introduced securities trading in India, replaced its open outcry system of trading in 1995, when the totally automated trading through the BSE Online trading system was put into practice. The BOLT network was expanded, nationwide, in 1997. It was at the BSE’s International Convention Hall that India’s 1st Bell ringing ceremony in the history Capital Markets was held on February 18th, 2002. It was the listing ceremony of Bharti Tele ventures Ltd.

BSE with its long history of capital market development is fully geared to continue its contributions to further the growth of the securities markets of the country, thus helping India increase its sphere of influence in international financial markets.

NSE

In the fast growing Indian financial market, there are 23 stock exchanges trading securities. The National Stock Exchange of India (NSE) situated in Mumbai—is the largest and most advanced exchange with 1016 companies listed and 726 trading members.

The NSE is owned by the group of leading financial institutions such as Indian Bank or Life Insurance Corporation of India. However, in the totally de-mutualised Exchange, the ownership as well as the management does not have a right to trade on the Exchange. Only qualified traders can be involved in the securities trading.

The NSE is one of the few exchanges in the world trading all types of securities on a single platform, which is divided into three segments: Wholesale Debt Market (WDM), Capital Market (CM), and Futures & Options (F&O) Market. Each segment has experienced a significant growth throughout a few years of their launch.

The National Stock Exchange of India has stringent requirements and criteria for the companies listed on the Exchange. Minimum capital requirements, project appraisal, and company’s track record are just a few of the criteria. In addition, listed companies pay variable listing fees based on their corporate capital size.

The National Stock Exchange of India Ltd. provides its clients with a single, fully electronic trading platform that is operated through a VSAT network. Unlike most world exchanges, the NSE uses the satellite communication system that connects traders from 345 Indian cities. The advanced technologies enable up to 6 million trades to be operated daily on the NSE trading platform.